Original Article - Year 2024 - Volume 39 -

Cosmiatry: An analysis of the Brazilian market

Cosmiatria: Uma análise do mercado brasileiro

ABSTRACT

Introduction: The aesthetic procedure market is growing exponentially in Brazil. This growth has aroused the interest of several professional categories. The decision to practice in the sector must consider the market opportunities in the location in which you intend to operate. However, the area lacks comparative analyses documenting probable regional differences in the country. The objective of the study is to describe market differences in aesthetic procedures between Brazilian states and regions. An index of potential cosmetic consumption (IPCC) is calculated for such a comparative analysis.

Method: Cross-sectional study involving providers of nonsurgical aesthetic procedures in Brazil. Searches on Google Maps® were conducted using key terms, and telephone interviews were conducted to obtain information on professional categories, types of providers, and services offered. Positive predictive values were obtained for all search strategies and used to estimate the total number of providers. Population size and per capita income were considered to calculate the IPCCs for Brazilian states.

Results: São Paulo, Minas Gerais, and Rio de Janeiro presented the highest IPCCs, being 524, 210, and 180, respectively. Roraima had an IPCC of 14, the lowest in the country. The Southeast Region presented, on average, the highest IPCC (242) among all Brazilian regions.

Conclusion: Considering population size and income, the Southeast Region presents the greatest market opportunities for nonsurgical aesthetic procedures in Brazil. Our findings may be of interest to healthcare professionals and investors who work or intend to work in the sector.

Keywords: Cosmetic techniques; Surgery; plastic; Esthetics; Plastic surgery procedures; Beauty and aesthetics centers; Botulinum toxins; type A; Dermal fillers

RESUMO

Introdução: O mercado de procedimento estéticos cresce exponencialmente no Brasil. Tal crescimento tem despertado o interesse de várias categorias profissionais. A decisão de praticar no setor deve considerar as oportunidades de mercado da localidade na qual se pretende atuar. Entretanto, a área carece de análises comparativas documentando prováveis diferenças regionais no país. O objetivo do estudo é descrever as diferenças de mercado em procedimentos estéticos entre os estados e regiões brasileiras. Um índice de potencial consumo de cosmiatria (IPCC) é calculado para tal análise comparativa.

Método: Estudo transversal envolvendo prestadores de procedimentos estéticos não cirúrgicos no Brasil. Buscas no Google®-Google Maps® foram conduzidas usando termoschave e entrevistas telefônicas realizadas para obter informações sobre categorias profissionais, tipo de provedores e serviços oferecidos. Valores preditivos positivos foram obtidos para todas as estratégias de busca e usados para estimar o número total de provedores. O tamanho da população e a renda per capita foram considerados para o cálculo dos IPCCs para os estados brasileiros.

Resultados: São Paulo, Minas Gerais e Rio de Janeiro apresentaram os maiores IPCCs, sendo 524, 210 e 180, respectivamente. Roraima teve um IPCC de 14, o mais baixo do país. A Região Sudeste apresentou, em média, o maior IPCC (242) entre todas as regiões brasileiras.

Conclusão: Considerando o tamanho da população e a renda, a Região Sudeste apresenta as maiores oportunidades de mercado em procedimentos estéticos não cirúrgicos no Brasil. Nossos achados podem ser de interesse para profissionais de saúde e investidores que atuam ou pretendem atuar no setor.

Palavras-chave: Técnicas cosméticas; Cirurgia plástica; Estética; Procedimentos de cirurgia plástica; Centros de embelezamento e estética; Toxinas botulínicas tipo A; Preenchedores dérmicos

INTRODUCTION

Aesthetic procedures have grown considerably around the world in recent years. In 2020, 24,529,875 aesthetic procedures were performed globally, which represents a cumulative increase of 11.9% compared to the 21,921,285 procedures estimated for 20161. Despite the COVID-19 pandemic, the number of nonsurgical aesthetic procedures in 2020 increased by 4.7% when compared to 20191. Considering the absolute number of procedures by country, together with the United States, Brazil occupies a leading position1. When population sizes are taken into account, Brazil and Argentina occupy the top positions, with 715 and 631 procedures per 100,000 people, respectively2.

Recently, our group demonstrated the existence of an “epidemic” of botulinum toxin injectors in Brazil3. More than 139 thousand health professionals practice in the sector in the country. Approximately 85% of these professionals are represented by dentists, while only 4% are plastic surgeons.

Nonsurgical aesthetic interventions are considered procedures that can be performed in offices and clinics. Such aesthetic procedures include injectables (botulinum toxin, hyaluronic acid, calcium hydroxyapatite, poly-L-lactic acid, and others), chemical and ablative peelings, photorejuvenation, waxing, and nonsurgical fat reduction.

The beauty industry, including the cosmetics segment, is a multibillion-dollar market with notable growth projections. The global cosmetic surgery market is expected sto grow from us$ 46.45 billions in 2023 to us$63.66 billions in 2027. In Brazil, with the popularization of nonsurgical aesthetic procedures and the growing number of professionals practicing in the sector, saturation of the market becomes a concern. It is worth noting the significant growth of franchises that provide these services in Brazil in recent years5.

Several factors can influence opportunities in the aesthetics market in Brazilian states. The number of inhabitants and per capita income per state are factors to be considered by professionals who wish to practice in the sector. However, there is a scarcity of analyses comparing the aesthetics market between Brazilian states and regions.

OBJECTIVE

In order to describe the current situation of aesthetic services, as well as the potential for consumption of such services between states and regions in Brazil, we carried out a national survey with professionals and clinics in the area.

METHOD

The present study was carried out at the Plastic Surgery Service of the Hospital das Clínicas of the Federal University of Pernambuco (HC-UFPE) in Recife-PE from June to December 2022. This is a national cross-sectional study involving providers of nonsurgical aesthetic procedures in Brazil. The study was divided into two phases: 1) Identification of beauty professionals through a Google Maps® search and 2) Telephone interviews to characterize the professional categories, type of suppliers (clinics, franchises, or exclusive offices of health professionals), and information about services provided. The Brazilian Institute of Research and Consulting® provided operational assistance to conduct all telephone interviews. The interviewers were independent employees who were not part of the researchers’ group.

A search strategy was established using six keywords: “aesthetics”, “aesthetics clinic”, “toxin”, “botulinum toxin”, “Botox®,” and “facial harmonization”. All search terms were used in combination with the names of the 26 Brazilian states and the Federal District. We chose to prioritize terms related to botulinum toxin as it is the most performed nonsurgical aesthetic procedure in the world6. Thus, we hope to capture the majority of providers performing all related procedures.

The initial screening, whether by checking advertisements or consulting websites/social networks, allowed the exclusion of results unrelated to search strategies (for example, pet stores) and invalid contact data. Subsequently, telephone calls made it possible to confirm the real number of cosmetic suppliers on the search strategy list. For the first three federative units analyzed (São Paulo, Pernambuco, and Distrito Federal), our main search terms generated a positive predictive value (PPV) of 48.7% (± 6.1%) for botulinum toxin suppliers and a VPP of 42% (± 5.3%) for clinics that provide nonsurgical aesthetic services.

After removing duplicates for the six search combinations, a final PPV of 16.4% (0.1-33% at 95% confidence interval) was observed for all search terms combined. Assuming that Google Maps® searches would suffer the same interference from unwanted results, the final VPP obtained was used to estimate the number of cosmetic services for all other states, thus enabling a comparative analysis between them.

A questionnaire was developed as a guide for interviewers (Chart 1). All declines, invalid Internet phone numbers, and uncompleted calls were documented. Based on telephone interviews from aesthetic clinics, the percentage and number of different professional categories working in these clinics were determined. Next, new search strategies were carried out for each category for all Brazilian states (i.e., “dentist” and “state name”).

| SURVEY QUESTIONNAIRE | |

|---|---|

| 1. | Do you offer botulinum toxin applications? |

| 2. | What are the professional categories that make applications? How many professionals work in your clinic or office? |

| 3. | What is the brand of your botulinum toxin (trade name)? |

| 4. | What is the application value per unit of toxin? |

| 5. | What is the nearest available time for toxin application? |

| 6. | What other beauty services do you offer? |

| 7. | If other services are offered, who are the professionals who perform them? |

| 8. | If offered, what is the name of your filler (business name)? |

| 9. | What equipment does your clinic have (laser, ultrasound, etc.)? |

Telephone interviews were also conducted to obtain information about the percentage of professionals who perform cosmetic procedures and their fees. Convenient samples corresponding to approximately 10% of the research results obtained for each state were interviewed. No personal identifiers of the assistants or providers were recorded during the interviews.

National data from professional societies of dentists, dermatologists, and plastic surgeons were used to estimate the total number of professionals providing nonsurgical aesthetic procedures for the entire country. Therefore, the total number of these professionals working in the area was estimated based on the total number of individual clinics and/or providers.

With the aim of comparing market opportunities between Brazilian states, an index of potential cosmetic consumption (IPCC) was calculated by adjusting the number of services by population and monthly nominal household income per capita by the Brazilian state. Data regarding population and income were obtained from the Brazilian Institute of Geography and Statistics (IBGE) 20217,8.

The results were presented in absolute numbers and percentages. Means or medians with standard deviations or interquartile ranges were reported where appropriate. The research data was aggregated and extrapolated to all Brazilian states. Results were based on a 95% confidence level with a margin of error of ± 3.9%. One-way analysis of variance (ANOVA) test was performed to compare fees between professionals and the franchise.

The study did not need to be submitted to the Research Ethics Committee (CEP) as it was market research carried out on the Internet and through telephone calls to aesthetic clinics without involving patients. The study followed the Helsinki principles. This secondary analysis is part of a study protocol that was published in the National Registry of Research Protocols for Federal University Hospitals in Brazil (Rede Pesquisa, Ebserh, Federal University Hospitals, project code 4312, HC-UFPE).

RESULTS

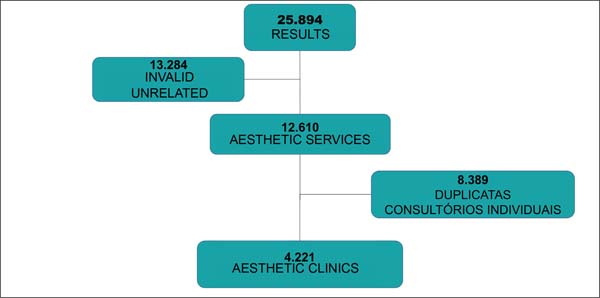

All search strategies resulted in 25,894 addresses on Google Maps® for the 26 Brazilian states and the Federal District. After excluding duplicates and unrelated results, as well as invalid contact numbers, 4,221 nonsurgical aesthetic services were found during the study period (Figure 1). A total of 2,270 telephone interviews were conducted.

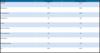

Of the 4,221 aesthetic clinics, 1,152 (27.3%) belonged to franchise networks. Dentists, biomedical doctors, and dermatologists represented 80% of the workforce (Table 1). On average, it was found that two professionals work in these clinics. The types of services offered by aesthetic clinics are detailed in Table 2.

| Category | Participation | Estimated Number |

|---|---|---|

| Dentists | 43% | 3,630 |

| Biomedical | 24% | 2026 |

| Dermatologists | 13% | 1,098 |

| Pharmacists | 4% | 338 |

| Nurses | 3% | 253 |

| Plastic Surgeons | 2% | 169 |

| Physiotherapists | 1% | 84 |

| Beauticians | 1% | 84 |

| Multiprofessionals | 9% | 760 |

| All | 100% | 8,442 |

| Botulinum toxin | 95% |

|---|---|

| Average number of professionals hired to apply toxin botulinum | 2 |

| *Average value per toxin unit botulinum | R$ 17.30 |

| Availability of clinic hours within 24 hours of the phone call | 59% |

| Hyaluronic acid | 90% |

| Calcium Hydroxyapatite/Poly-L-Lactic Acid | 65% |

| Support Wires | 25% |

| Microfocused and Macrofocused Ultrasounds | 10% |

| Laser | 7% |

| Electromagnetic Muscle Stimulation | 7% |

| Radiofrequency | 6% |

| Supramaximal Muscle Contractions | 2% |

* Value in Reais.

Table 3 shows the percentages of dentists, dermatologists, and plastic surgeons who perform nonsurgical aesthetic procedures and their estimated total numbers. Although only 31% of the dentists interviewed claim to apply botulinum toxin, the absolute number of these professionals is much higher than all other categories combined.

| Category | Total number of professionals in Brazil | Percentage operating in the market | Estimated

number acting in the market |

|---|---|---|---|

| Dentists | 376,067 | 31% | 116,957 |

| Dermatologists | 9,685 | 87% | 8,678 |

| Plastic Surgeons | 7,079 | 76% | 5,359 |

Plastic surgeons and dermatologists had the highest botulinum toxin injection rates compared to dentists and franchises. As previously reported, franchise fees were approximately 27% lower than those of plastic surgeons.

By combining the number of professionals working in clinics and individual offices, our group recently estimated and published a total of 139,436 providers of nonsurgical aesthetic procedures in Brazil. Dentistry was by far the most common professional category, representing approximately 87% of aesthetic procedure providers3.

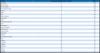

The rates of professionals working in the sector per 100,000 inhabitants are available in Table 4. São Paulo has the lowest number of professionals per population, while Roraima has the highest rate. The ranking of Brazilian states according to the IPCC is also presented in Table 4. São Paulo, Minas Gerais, and Rio de Janeiro have the highest IPCCs in Brazil. Acre, Amapá, and Roraima have the lowest rates among Brazilian states. Figure 2 shows the IPCC by region of the country. The IPCC for the Southeast is clearly higher than the indices for other Brazilian regions.

| STATE | SERVICE/100,000 POPULATION | IPCC |

|---|---|---|

| São Paulo | 3 | 524 |

| Minas Gerais | 6 | 210 |

| Rio de Janeiro | 10 | 180 |

| Rio Grande do Sul | 12 | 143 |

| Paraná | 11 | 140 |

| Bahia | 7 | 117 |

| Pará | 8 | 103 |

| Santa Catarina | 17 | 99 |

| Amazonas | 8 | 94 |

| Goiás | 16 | 81 |

| Mato Grosso do Sul | 20 | 73 |

| Ceará | 13 | 70 |

| Pernambuco | 12 | 69 |

| Distrito Federal | 39 | 65 |

| Mato Grosso | 21 | 65 |

| Espírito Santo | 24 | 54 |

| Maranhão | 12 | 53 |

| Paraíba | 19 | 45 |

| Rio Grande do Norte | 32 | 35 |

| Piauí | 24 | 35 |

| Alagoas | 24 | 32 |

| Tocantins | 34 | 30 |

| Sergipe | 35 | 26 |

| Rondônia | 47 | 22 |

| Acre | 47 | 19 |

| Amapá | 54 | 16 |

| Roraima | 73 | 14 |

DISCUSSION

Our study provided comprehensive estimates of the total number of providers of nonsurgical cosmetic procedures and their participation in the provision of such services in Brazil. Based on these estimates, adjusting for population and per capita household income by state, we created the IPCC, an index of potential consumption of cosmetics, enabling a comparative analysis of market opportunities for nonsurgical aesthetic procedures in Brazil. We are not aware of similar studies on sector-specific estimates.

The Southeast Region, particularly the states of São Paulo, Minas Gerais, and Rio de Janeiro, stood out for its high IPCCs. This finding suggests that market opportunities in this region would be greater than in other regions of Brazil. Although these three states have the highest absolute numbers of aesthetic services, their vast populations and higher per capita incomes make them more favorable places for professionals in the field to practice. This information can be particularly valuable for new professionals in the field when deciding to start their activities in certain regions of Brazil.

Recently, our group demonstrated the existence of an “epidemic” of botulinum toxin injectors in Brazil3. More than 139,000 injectors were designed, which represents approximately 0.7 professionals for every 1,000 Brazilians. Furthermore, although the majority of dermatologists and plastic surgeons performed nonsurgical aesthetic procedures, the vast majority (87%) of professionals working in the field were dentists.

The rapid growth of the sector and the role of non-medical professionals was a subject of debate in our previous publication and other studies9,10. Lately, cases of complications associated with aesthetic procedures performed by dentists have been documented in Brazil11,12. In the United States, as might be expected, a study on the practice of laser hair removal by non-physicians demonstrated an increase in the number of lawsuits13.

We found that most clinics offer injectables such as botulinum toxin and hyaluronic acid. However, a small proportion have more advanced technologies for cosmetic procedures. Such technologies require greater expertise and higher costs.

Approximately 60% of clinics had appointment availability within 24 hours following the telephone interview. This data allows us to evaluate the supply-demand relationship for such aesthetic procedures. Despite high demand, the significant increase in aesthetic clinics in recent years, particularly linked to franchises, has facilitated rapid access to nonsurgical cosmetic procedures.

Finally, we previously demonstrated that the prices for aesthetic procedures are lower in franchise clinics, which presumably explains the popularization of such procedures among segments of society with lower household incomes. However, an American study showed a greater public preference for doctors to perform aesthetic procedures14.

Our study has several limitations. First, an Internet search was used to identify providers of nonsurgical aesthetic procedures. However, not all suppliers, at the time of the research, could have active online advertising, which could underestimate the number of aesthetic clinics detected. Additionally, although we selected the categories of providers most likely to perform cosmetic procedures, other providers may have been missed. Finally, the use of per capita household income to evaluate market opportunities may not necessarily be related to the desire and potential to consume such services.

CONCLUSION

When population and per capita household income are considered, significant differences are documented between Brazilian states regarding the potential consumption of beauty services in Brazil. Based on the Potential Cosmetics Consumption Index, the Southeast Region presents the best market opportunities in the sector of nonsurgical aesthetic procedures among Brazilian regions.

The existence of an “epidemic” of providers of nonsurgical aesthetic procedures in Brazil is a reality. Currently, the market is dominated by non-physicians, mainly dentists.

REFERENCES

1. International Society of Aesthetics Plastic Surgery (ISAPS). ISAPS International Survey on Aesthetic/Cosmetic Procedures performed in 2020. West Lebanon: ISAPS; 2020 [acesso 2020 Fev 2]. Disponível em: https://www.isaps.org/wp-content/uploads/2022/01/ISAPS-Global-Survey_2020.pdf

2. Cosmetic Surgery Solicitors. The Countries With the Largest Number of Cosmetic Surgeries. Manchester: Cosmetic Surgery Solicitors; 2020 [acesso 2023 Fev 2]. Disponível em: https://www.cosmeticsurgerysolicitors.co.uk/news/countries-largest-number-cosmetic-surgeries

3. Nascimento BA Jr, de Souza MWF, Motta F, Torreão G, Barreto RC, Anlicoara R. The “epidemic” of nonsurgical cosmetic procedures providers in Brazil. J Plast Reconstr Aesthet Surg. 2023;79:11-2. DOI: 10.1016/j.bjps.2023.02.002

4. https://www.reportlinker.com/p06290024/Cosmetic-Surgery-Global-Market-Report.html. Acesso 2023 Dec 20

5. ABF. Portal do Franchising. Faturamento de franquias de beleza sobe 13,4% no primeiro trimestre de 2022 comparado ao mesmo período de 2021 [acesso 2022 Nov 3]. Disponível em: https://www.portaldofranchising.com.br/noticias/faturamento-de-franquias-debeleza-sobe-134-no-primeiro-trimestre-de-2022-comparado-ao-mesmo-periodo-de-2021/

6. statista. Top nonsurgical cosmetic procedures worldwide in 2021 [acesso 2022 Jun 3]. Disponível em: https://www.statista.com/statistics/293449/leading-nonsurgical-cosmeticprocedures

7. Instituto Brasileiro de Geografia e Estatística (IBGE). IBGE divulga o rendimento domiciliar per capita 2021. Rio de Janeiro: IBGE; 2021 [acesso 2023 Abr 16]. Disponível em: https://ftp.ibge.gov.br/Trabalho_e_Rendimento/Pesquisa_Nacional_por_Amostra_de_Domicilios_continua/Renda_domiciliar_per_capita/Renda_domiciliar_per_capita_2021.pdf

8. Instituto Brasileiro de Geografia e Estatística (IBGE). Cidades e Estados. São Paulo. Rio de Janeiro: IBGE; 2023 [acesso 2023 Abr 16]. Disponível em: https://www.ibge.gov.br/cidades-e-estados/sp.html

9. Rossi AM, Wilson B, Hibler BP, Drake LA. Nonphysician Practice of Cosmetic Dermatology: A Patient and Physician Perspective of Outcomes and Adverse Events. Dermatol Surg. 2019;45(4):588-97.

10. Resneck JS Jr, Kimball AB. Who else is providing care in dermatology practices? Trends in the use of nonphysician clinicians. J Am Acad Dermatol. 200858(2):211-6.

11. Sociedade Brasileira de Dermatologia (SBD). Nova vítima de procedimentos estéticos feitos por dentistas mostra a importância de alerta de dermatologistas. Rio de Janeiro: SBD; 2019 [acesso 2022 Jul 7]. Disponível em: https://www.sbd.org.br/nova-vitima-de-procedimentos-esteticos-feitos-por-dentistas-mostra-a-importancia-de-alerta-de-dermatologistas

12. Pedron IG, Cavalcanti RR. Complicações da harmonização orofacial. Rev Bras Cir Plást. 2023;38(1):1-3.

13. Jalian HR, Jalian CA, Avram MM. Increased risk of litigation associated with laser surgery by nonphysician operators. JAMA Dermatol. 2014;150(4):407-11.

14. Bangash HK, Ibrahimi OA, Green LJ, Alam M, Eisen DB, Armstrong AW, et al. Who do you prefer? A study of public preferences for health care provider type in performing cutaneous surgery and cosmetic procedures in the United States. Dermatol Surg. 2014;40(6):671-8.

1. Hospital das Clínicas, Universidade Federal de

Pernambuco, Serviço de Cirurgia Plástica, Departamento de Cirurgia, Recife, PE,

Brazil

2. UNINASSAU, Recife, PE, Brazil

Corresponding author: Bartolomeu Antonio Nascimento Junior Hospital das Clínicas - UFPE, Avenida Prof. Moraes Rego, S/N, Cidade universitária, Recife, Pernambuco, Brazil, CEP: 50670-901, E-mail: barto.nascimentojr@outlook.com

Article received: April 29, 2023.

Article accepted: August 20, 2023.

Conflicts of interest: none.

Read in Portuguese

Read in Portuguese

Read in English

Read in English

PDF PT

PDF PT

Print

Print

Send this article by email

Send this article by email

How to Cite

How to Cite

Mendeley

Mendeley

Pocket

Pocket

Twitter

Twitter